Ultimate Step-by-Step Guide: Master Your KRA Returns Filing Today

Filing KRA returns can seem overwhelming, but with the right guidance, it’s a straightforward process. Whether you’re a first-time filer or just need a quick refresher, this comprehensive guide will walk you through mobile filing, handling P9 forms, and filing nil returns. Plus, we offer practical courses tailored for accounting and tax filing to help you master each step confidently.

Filing KRA Returns on Your Phone

Want to file KRA returns on your phone? It’s quick and easy! Here’s how:

- Open your phone’s browser

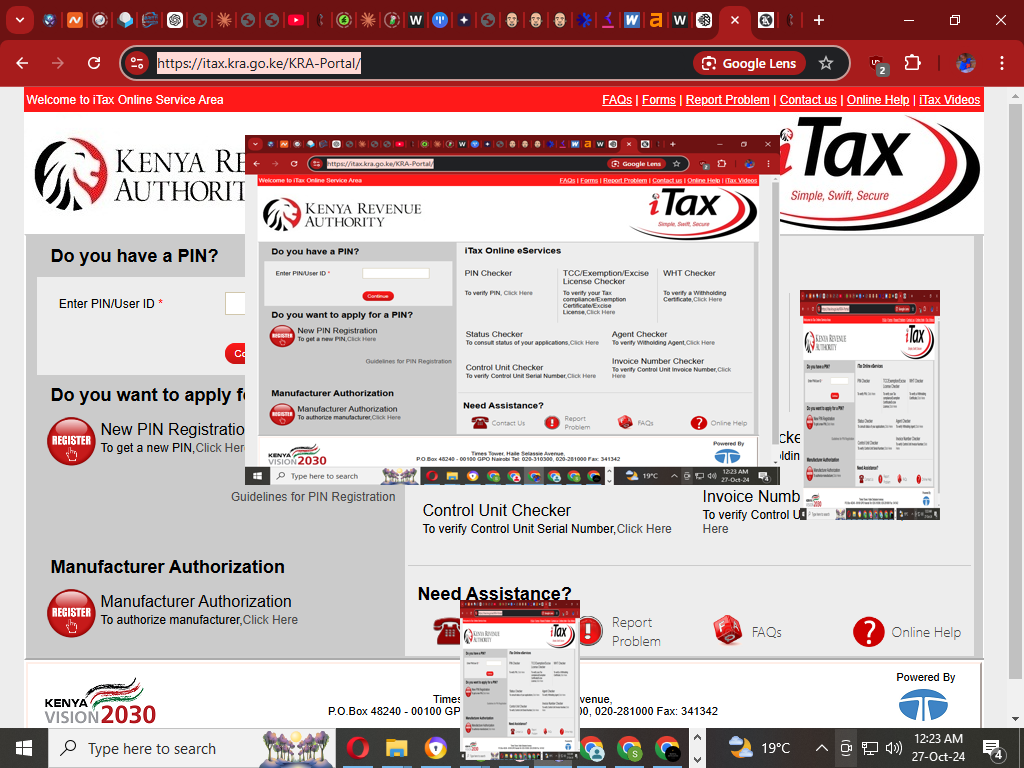

- Go to itax.kra.go.ke

- Enter your KRA PIN and password

- Click on ‘Returns’

- Follow the simple steps

No more trips to cyber cafes needed! The mobile site works great on any smartphone.

Accessing Your P9 Form Online

The P9 form is essential for employed individuals, as it contains all the income and tax details needed for accurate filing. Request your P9 form from your employer, or, if your company provides digital copies, download it directly from your HR portal. In case of a lost form, reach out to your HR department or finance team for assistance.

Step-by-Step Guide to Online Filing

Filing KRA returns online can be done on both phone and computer. Here’s how to get started:

- Gather Required Documents: You’ll need your KRA PIN, password, and P9 form.

- Log in to the iTax Portal: Visit itax.kra.go.ke and log in.

- Select Return Type: Choose either Individual Return (if employed) or Nil Return (if you had no income).

- Enter Employment Details: Input information from your P9 form, including your gross income and tax deducted.

- Review and Submit: Double-check your details before submitting, then save or print the acknowledgment for your records.

With this approach, filing KRA returns becomes a manageable task, whether you’re using your phone or computer. This guide provides the essentials, but if you need hands-on guidance, consider enrolling in one of our practical courses for accounting and tax filing. Our courses cover every detail, ensuring you’re well-prepared to meet your tax obligations.

You can file KRA returns easily and confidently. With the right guidance and modern technology, anyone can complete their tax obligations confidently – whether on their phone or computer. The key is knowing the right steps to take.

Filing Nil Returns Made Simple

File a nil return to avoid penalties, even if you don’t have any income. Select “Nil Return” on the iTax portal and follow the simplified steps. You’ll need your KRA PIN and password but don’t have to input income details. Filing on time ensures you’re fully compliant with KRA requirements, even if you have no taxable income.

Pro Tips for Employee Returns

To make filing smoother, consider these key tips:

- Double-check figures from your P9 form to avoid errors.

- Include all income sources if you have multiple employment sources.

- Save digital copies of your submissions to keep records accessible.

- File early to avoid last-minute rushes, especially during peak tax seasons.

Boost Your Skills with Practical Courses

If you’re looking to sharpen your accounting or tax filing skills, click here to explore our practical courses. We offer in-depth guidance tailored to both beginners and experienced filers. Our hands-on training covers everything from navigating the iTax portal to handling complex forms like the P9, so you can confidently file accurate returns each tax season.

Filing KRA returns doesn’t have to be challenging. By following these steps, you’ll be ready to complete your filing accurately and stress-free. Get started today with our expert guidance, and make tax season easier than ever!